Credit Card Transfer Partners: Guide to Maximizing Points

Disclosure: This post may contain affiliate links, which earn me a small commission from bookings at no extra cost to you. Thank you for reading and supporting my blog!

So you’ve finally got a stash of points, but when you go to use them, every flights looks like it costs several hundred thousand points. How is everyone flying around the world for free? They are definitely not paying those prices, rather they are transferring their points to partners.

What does it mean to transfer credit card points to partners? What partners does my credit card have? How do you know how many points to transfer and to where? How does using transfer partners help you get more value out of your points? Knowing the the answers is key to using points the right way!

What Are Credit Card Transfer Partners?

When you earn points from certain credit card programs, you’re not just stuck redeeming them for gift cards or travel through your bank’s portal. Instead, you can transfer those points to airline and hotel loyalty programs, which have their own points prices for flights and stays.

The main credit card banks with transferrable points are American Express, Chase, Citi, and Capital One. Listed below is a chart of the most popular transfer partners and which banks transfer to them.

Why use transfer partners

Think of it like exchanging your game tokens at an arcade—some prizes (or in this case, travel redemptions) are way better than others. Now imagine there are different booths to redeem your tokens for the same prizes, and each booth has different price.

This is where it can start to get more complicated as many transfer partners offer the same flights within their airline alliance, but at different prices. They may not always have that same prize though, as flight award availability to partners can be restricted.

For example, you can book American Airlines flights through American Airlines, Alaska MileagePlan, and British Airways Executive Club. Delta flights can be booked through Delta, AirFrance Flying Blue, and Virgin Atlantic Flying Club.

Transferable points give you the flexibility of booking with the partner with the best price. The best way to know which partner may have the best price is by checking my travel on points cheatsheet.

When is it more valuable to transfer your points to a loyalty program?

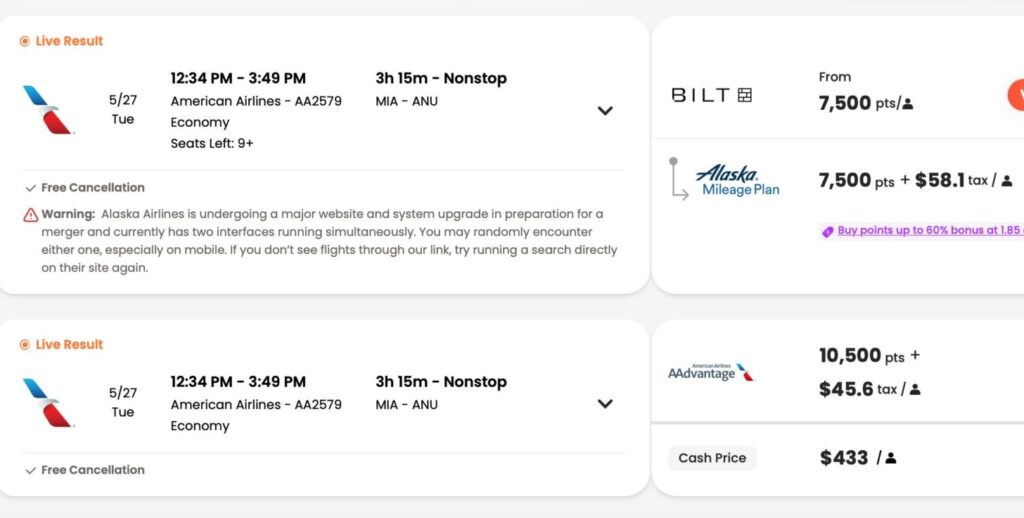

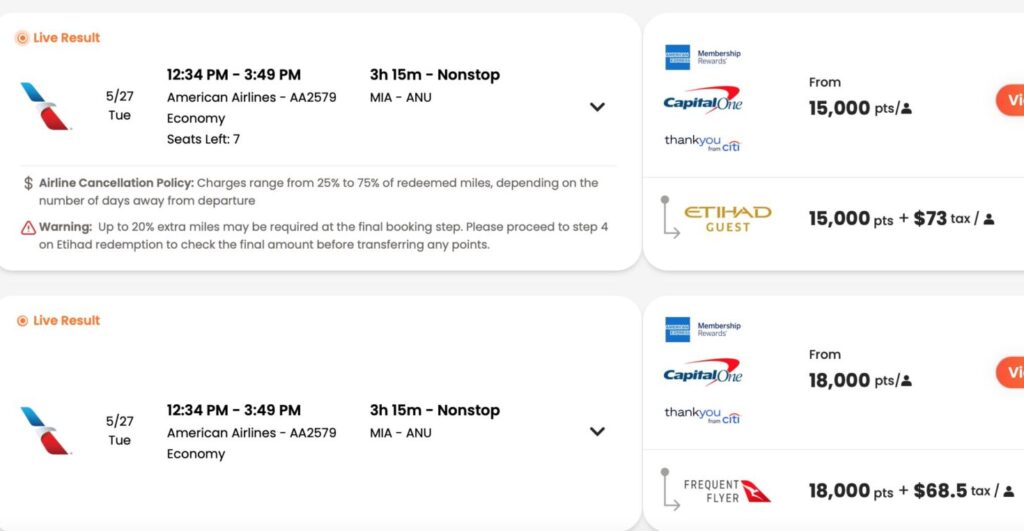

Transfer your points to a loyalty program when the points price is in you favor and cash rates are high. For example, this American Airlines flight from Miami to Antigua costs $433 one way in the main cabin, or you could instead use 7,500 Alaska MileagePlan points; 10,500 American Airlines miles; 15,000 points in Etihad; or 18,000 points in Qantas.

In the bank portal, points are only with a penny, so it would cost you 43,300 points. This is 2-4 times as many points than you would need if you just transferred the points to a loyalty program to book the same exact flight. You could fly your whole family out for the price of the one flight in the portal.

The savings can become even more dramatic when comparing costs for business class flights, which can cost thousands of dollars, but are usually well under 100,000 points in many loyalty programs.

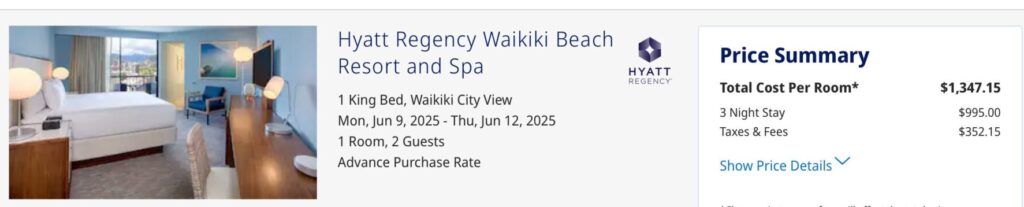

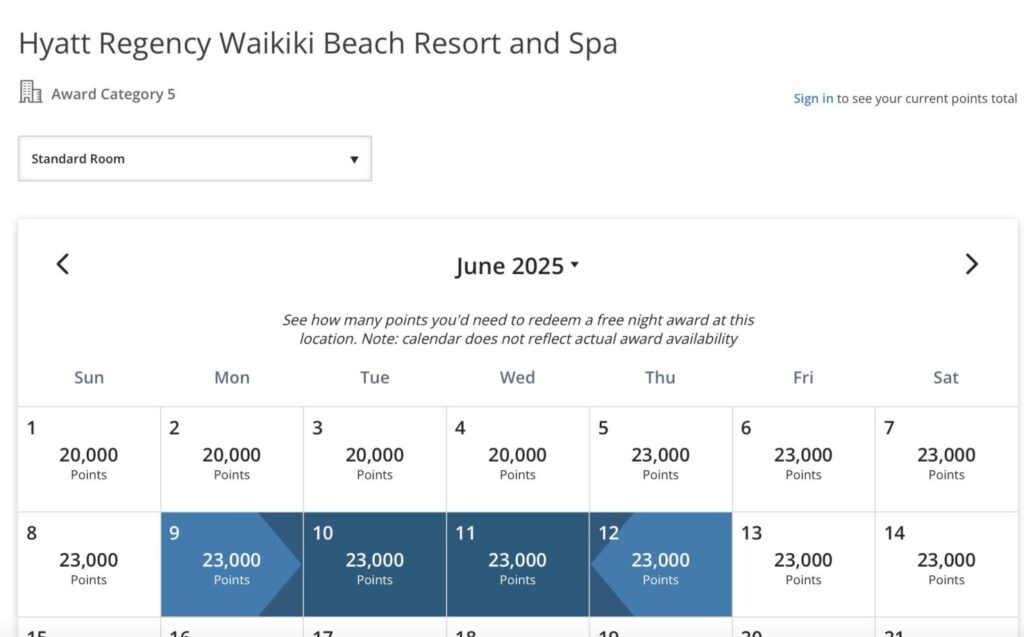

Hotel programs can also present tremendous savings. Three nights on the beach in Hawaii at the Hyatt Regency Waikiki could set you back $1,347.15, or 134,715 points in the portal, or only 69,000 Hyatt points when transferred from Chase.

Major Credit Card Transfer Programs and Their Partners

Each major credit card issuer has its own point system, and these points can be transferred to different airline and hotel partners. You can transfer points online in your bank rewards portal. Be sure to check each loyalty program’s change/cancelation policy as well as the taxes/fees when comparing flights. Here is a breakdown by bank and a chart of the most popular transfer partners.

Credit Card Transfer Partner Chart

| Transfer Partner | Chase Ultimate Rewards | Amex Membership Rewards | Capital One Miles | Citi ThankYou Points |

|---|---|---|---|---|

| United MileagePlus | ✅ | ❌ | ❌ | ❌ |

| Southwest Rapid Rewards | ✅ | ❌ | ❌ | ❌ |

| JetBlue TrueBlue | ✅ | ✅ | ❌ | ✅ |

| British Airways Executive Club | ✅ | ✅ | ✅ | ❌ |

| Air Canada Aeroplan | ✅ | ✅ | ✅ | ❌ |

| Air France/KLM Flying Blue | ✅ | ✅ | ✅ | ✅ |

| Singapore Airlines KrisFlyer | ✅ | ✅ | ✅ | ✅ |

| Virgin Atlantic Flying Club | ✅ | ✅ | ✅ | ✅ |

| Emirates Skywards | ✅ | ✅ | ✅ | ✅ |

| ANA Mileage Club | ❌ | ✅ | ❌ | ❌ |

| Cathay Pacific Asia Miles | ❌ | ✅ | ❌ | ❌ |

| Qantas Frequent Flyer | ❌ | ✅ | ✅ | ✅ |

| Avianca LifeMiles | ❌ | ✅ | ✅ | ✅ |

| Etihad Guest | ❌ | ✅ | ✅ | ✅ |

| Turkish Airlines Miles&Smiles | ❌ | ❌ | ✅ | ✅ |

| TAP Air Portugal Miles&Go | ❌ | ❌ | ✅ | ❌ |

| Delta SkyMiles | ❌ | ✅ | ❌ | ❌ |

| Hyatt | ✅ | ❌ | ❌ | ❌ |

| Marriott Bonvoy | ✅ | ✅ | ❌ | ❌ |

| IHG One Rewards | ✅ | ❌ | ❌ | ❌ |

| Hilton Honors | ❌ | ✅ (1:2) | ❌ | ❌ |

| Choice Privileges | ❌ | ✅ | ✅ | ✅ (1:2) |

| Wyndham Rewards | ❌ | ❌ | ✅ | ❌ |

Chase Ultimate Rewards

Chase is a favorite for beginners because their points are flexible and transfer at a 1:1 ratio to many popular travel programs. If you have a card like the Chase Sapphire Preferred or Chase Sapphire Reserve, or Ink Preferred card, then this allows you to transfer points to various partners. These cards also turn cash back cards like the Ink Unlimited into points earning cards, since you can move your points into the pool of the card that can transfer to partners.

Airline Transfer Partners (1:1 transfer ratio):

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards Miles

- Iberia Plus

- JetBlue TrueBlue

- Southwest Rapid Rewards

- Singapore Airlines KrisFlyer

- United MileagePlus

- Virgin Atlantic Flying Club

Hotel Transfer Partners (1:1 ratio):

- World of Hyatt (one of the best!)

- IHG One Rewards

- Marriott Bonvoy

American Express Membership Rewards

Amex is another powerhouse when it comes to transfer partners. With huge welcome bonuses and a robust program for businesses, American Express membership rewards are easy to stockpile and may have additional perks like lounge access.

Airline Transfer Partners (transfer ratio):

- Aer Lingus (1:1)

- Aeromexico Club (1:1.6)

- Air Canada Aeroplan (1:1)

- Air France/KLM Flying Blue (1:1)

- ANA Mileage Club (1:1)

- Avianca LifeMiles (1:1)

- British Airways Executive Club (1:1)

- Emirates Skywards (1:1)

- Cathay Pacific Asia Miles (1:1)

- Delta SkyMiles (1:1)

- Emirates Skywards (1:1)

- Etihad Guest (1:1)

- HawaiianMiles (1:1, backdoor to Alaska MileagePlan)

- Iberia Plus (1:1)

- JetBlue TrueBlue (250:200)

- Singapore Airlines KrisFlyer (1:1)

- Qantas Frequent Flyer (1:1)

- Qatar Airways Privilege Club (1:1)

- Virgin Atlantic Flying Club (1:1)

Hotel Transfer Partners:

- Hilton Honors (1:2)

- Marriott Bonvoy (1:1)

- Choice Privileges (1:1)

Capital One Miles

Capital One has improved its transfer partner game, making its points more valuable than ever. Cards like the Capital One Venture X and Venture Rewards allow you to transfer miles to airlines and hotels while earning at least 2x everywhere making it easy to rack up the rewards on everyday purchases. These cards also make rewards earned on cash back cards transferrable and the Venture X has lounge access.

Airline Transfer Partners (mostly 1:1):

- Aeromexico Club

- Air Canada Aeroplan

- Avianca LifeMiles

- British Airways Executive Club

- Air France/KLM Flying Blue

- Emirates Skywards

- Etihad Guest

- EVA Air (2:1.5)

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Air Portugal Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red (Virgin Atlantic)

Hotel Transfer Partners:

- Choice Privileges (1:1)

- Wyndham Rewards (1:1)

- Accor Live Limitless (2:1)

Citi ThankYou Points

Citi may not be as well-known for its transfer partners, but it still offers solid options. If you have a Citi Premier or Citi Prestige card, you can transfer points to the following programs. This also makes points earned on lower tier but higher earning cards like the citi double cash and custom cash transferable to all partners.

Airline Transfer Partners (1:1 ratio):

- Aeromexico Club

- Air France/KLM Flying Blue

- Avianca LifeMiles

- Cathay Pacific

- Emirates Skywards

- Etihad Guest

- EVA Air

- JetBlue Trueblue

- Qantas Frequent Flyer

- Qatar Privilege Club

- Singapore Airlines KrisFlyer

- Thai Royal Orchid Plus

- Turkish Airlines Miles&Smiles

- Virgin Atlantic Flying Club

Hotel Transfer Partners:

- Choice Privileges (1:2)

- Accor Live Limitless (2:1)

- Leaders Club (5:1)

- Preferred Hotels (1:4)

- Wyndham Rewards (1:1)

How to Use Credit Card Transfer Partners for Maximum Value

Now that you know where your points can go, here’s how to make them work for you:

- Find Sweet Spots – Each airline has its own award chart, and some offer way better redemptions than others.

- Look for Transfer Bonuses – Occasionally, credit card companies offer bonuses (like a 30% boost) when transferring points to certain partners. This can make your points stretch even further! Only transfer when you are ready to book or have a specific near term redemption in mind.

- Book Business and First Class Flights – Some of the best redemptions come from booking premium cabins. A flight that costs thousands of dollars might only cost you 70,000 points transferred to the right airline. That sure beats cashing out via the portal for $700.

- Know how much a flight is worth– Compare cash prices to my free cheatsheet that tells you by route and loyalty program what the best points pricing is.

Next Steps to Earning & Redeeming Points

Understanding credit card transfer partners can take your points game to the next level. Instead of redeeming for a flat cash-back rate, you can unlock huge value by booking flights and hotels strategically.

Grab my free starter guide below to transfer partner pricing and you’ll get tips every week in your inbox to make the most of your points.